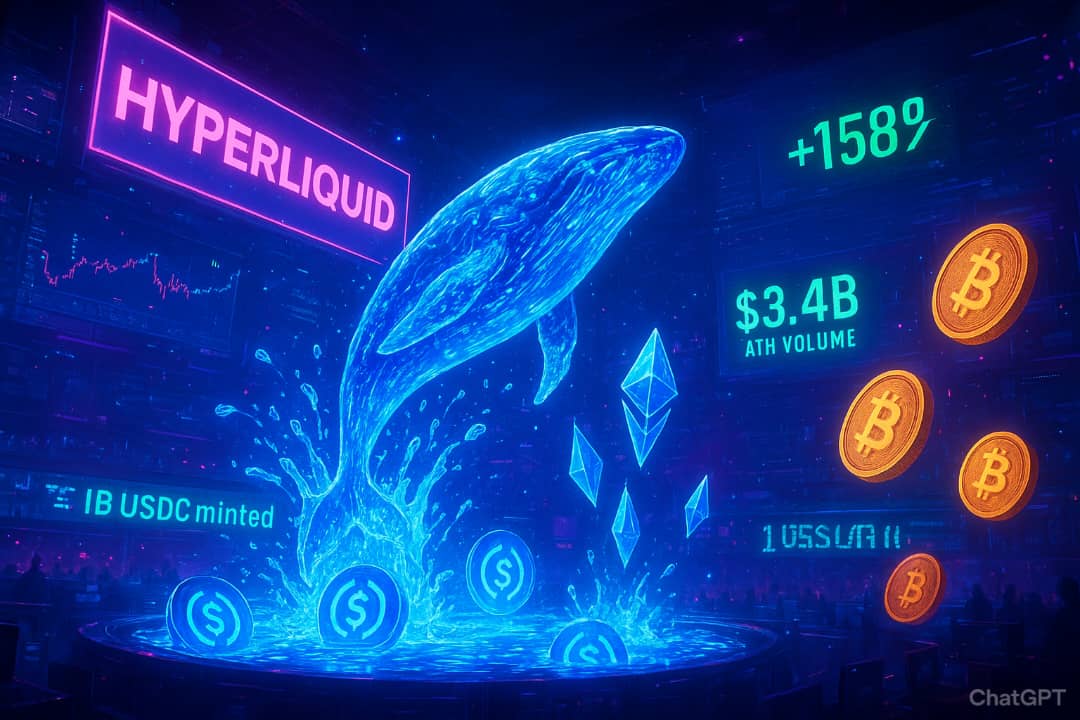

Spot trading on Hyperliquid hit a new 24-hour all-time high (ATH) of $3.4B, powered by rising BTC and ETH deposits. Activity from @hyperunit traders played a key role, pushing volumes across the board.

https://twitter.com/HyperliquidX/status/1959874702056567022?t=ps7VFlmCvImUSRNiX2Jh3A&s=19

This milestone makes Hyperliquid the second-largest venue for spot BTC trading across centralized and decentralized exchanges, clocking $1.5B in BTC spot volume alone.

Onchain Overview: Aug 18–Aug 24, 2025

Crypto markets stayed active last week, with total DEX trading volume posting a slight weekly increase. But Hyperliquid’s growth was the real headline, according to Lookonchain.

- Stablecoin holdings on Hyperliquid grew by $256M

- Spot trading volume surged 158.38%

A single whale move drove much of this action. The trader swapped $2.59B BTC for ETH, then opened a massive ETH long. The trade helped push ETH to a new all-time high.

Stablecoin Market Sees Mixed Flows

The total stablecoin market cap grew by $415.56M last week. But flows differed by chain:

- Hyperliquid stablecoin balances: + $256M

- Arbitrum stablecoin balances: – $455.6M

Meanwhile, monthly USDC senders neared all-time highs at ~9.4M. Solana dominated usage with ~3.3M monthly senders.

Adding fuel, @Circle minted 1B USDC on Solana in just 7 days. This brings the 2025 total to $25B minted on the network.

https://twitter.com/SolanaFloor/status/1959903459354038756?t=5m39SyX0oilqnsdJjyZi_w&s=19

DEX trading stayed strong, with spot and perps volumes both rising last week.

Spot trading volume hit $125.917B, up 1.33% week-over-week (WoW).

Breakdown by platform:

- Uniswap: $35.573B (–6.00% WoW)

- PancakeSwap: $14.816B (+11.51% WoW)

- Hyperliquid: $8.599B (+158.38% WoW)

On the perps side, total DEX volume hit $166.654B, up 1.20% WoW.

Breakdown:

- Hyperliquid: $105.314B (+0.81% WoW)

- edgeX: $13.254B (+42.72% WoW)

- Jupiter: $6.151B (–9.94% WoW)

Hyperliquid now controls over 63% of all DEX perps trading.

Corporate Bitcoin Buys Continue

Seven listed companies bought 3,715 BTC last week, adding roughly $417M in exposure. Institutional interest in BTC continues to rise, even as ETH grabbed headlines from whale trades.

The biggest move came from a Bitcoin OG wallet. The address, which received 100,784 BTC seven years ago (worth $642M then, now $11.4B), finally made a massive shift.

- Sold 22,769 BTC worth $2.59B

- Bought 472,920 ETH worth $2.22B spot

- Opened a 135,265 ETH long worth $577M

https://twitter.com/tokenterminal/status/1959642807875830142?t=5m39SyX0oilqnsdJjyZi_w&s=19

This single trade drove Hyperliquid spot volumes to $8.599B, up 158.38% WoW, and pushed ETH to record highs.

Big Picture: Hyperliquid Takes Center Stage

Hyperliquid is now shaping onchain liquidity trends:

- BTC spot trading ranks second only to Binance.

- Stablecoin inflows keep growing, led by Solana USDC activity.

- Perps dominance holds steady despite rising DEX competition.

Whales are back in the market. Institutions keep buying BTC. ETH just saw one of its biggest weekly catalysts of 2025.

If the past week is any sign, Hyperliquid is becoming the go-to venue for both spot and perps trading across DeFi.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!