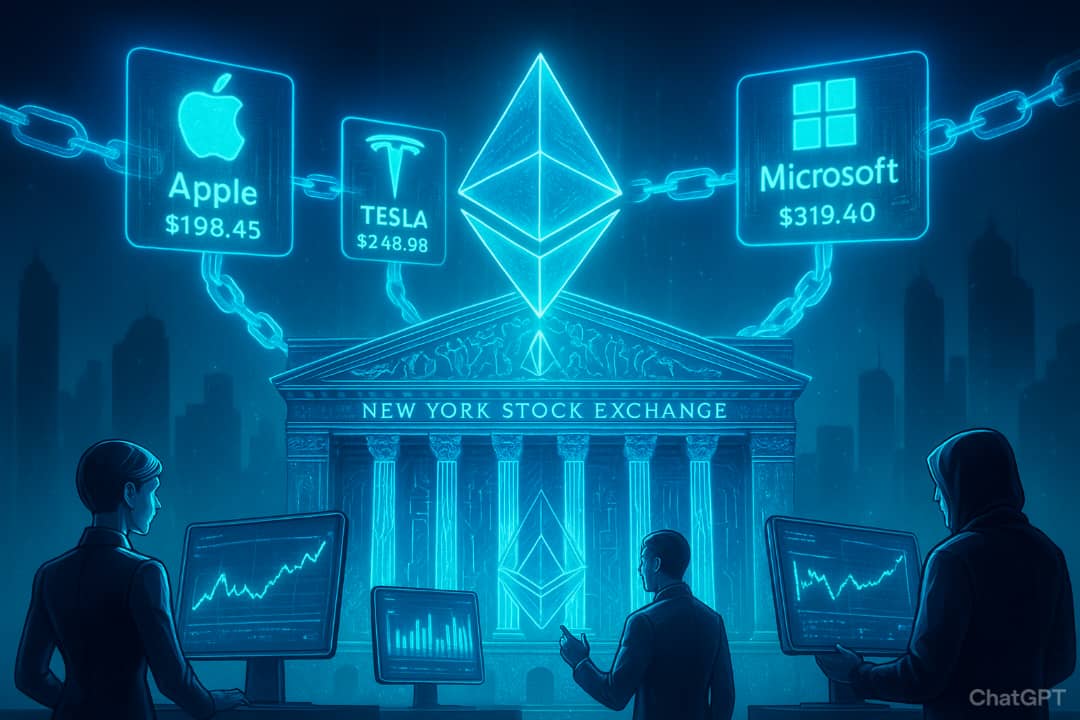

Ondo Finance just flipped the switch on what it calls its biggest product launch yet. The company has rolled out Ondo Global Markets, a platform that lets non-U.S. investors trade tokenized versions of U.S.-listed stocks and ETFs directly on Ethereum.

This means investors outside the United States can now buy and sell tokenized shares of companies like Apple, Microsoft, and Tesla, alongside major ETFs, in real time, all on-chain.

The platform went live today with more than 100 securities. Ondo confirmed plans to expand this list to 1,000+ assets by the end of 2025, pending regulatory clearance.

1/ Wall Street 2.0 is here.

Ondo Global Markets is now live, providing one of the largest-ever selections of tokenized U.S. stocks & ETFs onchain with the liquidity of traditional finance, starting on @Ethereum.

100+ assets now live, with hundreds more on the way. pic.twitter.com/caHhT0gRX5

— Ondo Finance (@OndoFinance) September 3, 2025

Largest Tokenized Equities Launch Yet

Ondo calls this the largest launch of tokenized equities to date. Each token mirrors the value of its underlying asset.

Every share is fully backed by real-world stocks or ETFs held with U.S.-registered broker-dealers and regulated custodians. That backing ensures each token inherits the liquidity of its traditional counterpart.

What does that mean? Investors trade on-chain while prices stay aligned with the real-world market. Slippage stays low. Pricing discrepancies fade out.

During U.S. market hours, minting and redemption happen instantly. Tokens can be created or redeemed for the underlying asset without delay.

Transfers, however, don’t stop. They remain available 24/7 on Ethereum.

Ondo also feeds dividends and corporate actions directly into the token’s value. Holders get the same total return exposure they would if they owned the real-world stock or ETF.

A “Wall Street 2.0” Vision

This launch marks a big step in Ondo’s “Wall Street 2.0” roadmap, a plan to modernize traditional markets using blockchain tech.

The company says this is just the start. It plans to bring these tokenized securities to BNB Chain, Solana, and its own Ondo Chain in the coming months.

Ondo Chain will add advanced features:

- Automated on-chain asset management

- Institutional borrowing against tokenized assets

- Staking for network security

- Cross-chain token issuance

- Expanded collateral options for DeFi platforms

The goal? Create a full ecosystem where traditional and decentralized finance finally merge.

ONDO Seamless Access Across DeFi

Ondo partnered with major crypto wallets and exchanges to make trading frictionless:

Gate

MEXC

Trust Wallet

OKX Wallet

Bitget Wallet

CoinMarketCap

Blockchain.com

CoinGecko

1inch

LBank

LayerZero

CoW Protocol

Alpaca

Morpho

BitGo

Ledger

RWA.xyz

These integrations help investors manage and transfer assets across the entire DeFi ecosystem without extra steps.

Ondo knows institutions demand strong safeguards. That’s why it built a three-layer security structure:

1. Fully backed: Every tokenized security ties directly to real-world assets held by regulated U.S. broker-dealers and custodians.

2. Daily verification: A third-party Verification Agent reviews backing each day to ensure one-to-one coverage.

3. First-priority rights: A Security Agent holds top-priority rights over the underlying assets for the benefit of token holders.

Ondo says these measures make the structure bankruptcy remote and fully enforceable.

Institutional-Grade Trading Features

Ondo Global Markets introduces a next-gen feature set for tokenized stocks and ETFs:

- 24/7 peer-to-peer transfers across Ethereum

- 24/5 instant minting & redemption during U.S. market hours

- Access to traditional exchange liquidity for real-world pricing alignment

- Full DeFi compatibility for integrations with lending, staking, and liquidity protocols

The idea is to give investors institutional-grade confidence while keeping the advantages of decentralized finance intact.

Tokenization of real-world assets (RWAs) keeps gaining momentum. Market analysts say the RWA tokenization market could hit trillions in value over the next few years.

By offering U.S. stocks and ETFs on-chain, Ondo Finance just opened the door for non-U.S. investors who previously faced heavy friction in accessing U.S. markets.

This also unlocks new tools for DeFi platforms to use tokenized equities as collateral, build lending markets, or design structured products that combine traditional assets with crypto-native yield strategies.

Ondo’s next steps:

- Expand beyond 100 tokenized securities to over 1,000 assets by end-2025

- Roll out cross-chain support for Solana, BNB Chain, and Ondo Chain

- Launch on-chain asset management tools for institutions and DeFi protocols

- Integrate staking, borrowing, and cross-chain token issuance

The company says it wants to build the global standard for tokenized financial markets.

Final Thoughts

Ondo Global Markets feels like a big deal because it connects two worlds:

- Traditional equities with strict regulations and deep liquidity

- Decentralized finance with borderless, 24/7 trading and composability

If the platform scales as planned, it could bring hundreds of billions in real-world assets onto public blockchains, maybe even more.

The race to tokenize the world’s financial markets just got a new leader.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!