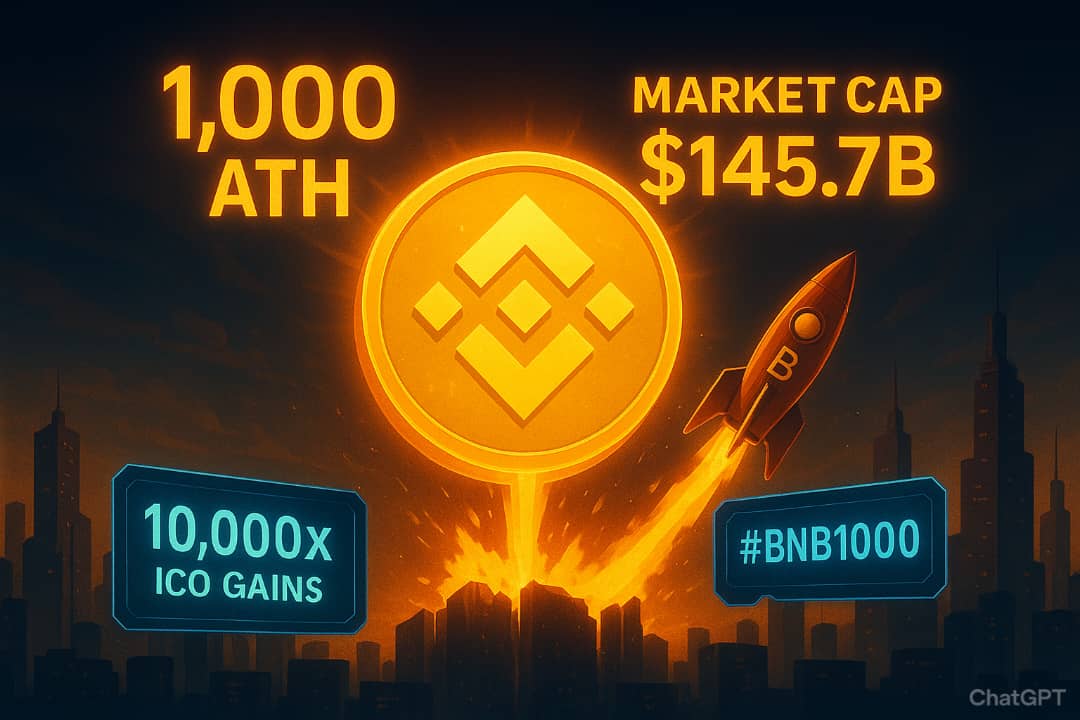

$BNB has broken through a historic milestone. The token surged past $1,000, setting a new all-time high with a market cap of $145.7B, according to CoinMarketCap.

The rally followed Binance’s treasury adjustments, with plans to rotate $BTC and $ETH into $BNB. In August, BNB Smart Chain ranked 2 in crypto by fees, generating $345M in a single month.

From its ICO price of $0.10 in 2017 to today’s four-digit level, $BNB has returned nearly 10,000x. A $10 investment at ICO is now worth $100,000.

Legendary Diamond Hands

Stories of early believers are now crypto folklore.

Wallet 0x8503 spent less than $1K to buy 999 $BNB at ~$1 per token. Today, that bag is worth ~$1M, a 1,000x return.

BNB just broke $1,000 today! @cz_binance

Diamond Hand 0x8503 spent less than $1K to buy 999 $BNB eight years ago, when the price was only ~$1.

Now, those 999 $BNB are worth ~$1M, a 1,000x return.https://t.co/DIkr8auXWA pic.twitter.com/4qZElFjyt5

— Lookonchain (@lookonchain) September 18, 2025

The rise cements $BNB’s place as one of the most profitable ICO investments in history.

CZ Speaks Out

In a rare tweet, Binance founder CZ commented not as an executive, but as a community member:

“I, not representing any entity or title, as just a community member and a BNB holder, thank everyone in the BNB and crypto ecosystem, for your support.”

Watching #BNB go from $0.10 ICO price 8 years ago to today's $1000 is something words cannot explain.

I, not representing any entity or title, as just a community member and a #BNB holder, thank everyone in the #BNB and crypto ecosystem, for your support.

We had our challenges…

— CZ 🔶 BNB (@cz_binance) September 18, 2025

That message hit home with loyal holders, reinforcing the sense that BNB has outgrown its exchange-token roots and is now a full ecosystem asset.

Why Did $BNB Reach $1,000?

The rally wasn’t the result of a single catalyst. It was a convergence of regulatory clarity, macroeconomic easing, strong fundamentals, and bullish sentiment.

1. Regulatory shift, Binance’s negotiations with the U.S. Department of Justice over lifting its independent compliance monitor eased legal fears.

2. Macroeconomic backdrop, The Federal Reserve cut rates by 25 basis points in September, opening liquidity and boosting appetite for risk assets.

3. Deflationary supply, Quarterly burns destroyed 1.6M BNB in July, reducing circulating supply to 139M.

4. On-chain strength, BNB Chain TVL climbed to $7.8B, with nearly 10M daily transactions.

5. Social momentum, Speculation over CZ’s possible return, coupled with community-driven hashtags like BNB1000, stoked investor optimism.

If you had invested $10 at $BNB’s ICO in 2017, today it would be worth $100,000.

-> From $0.10 ICO price → now trading in 4 digits (10,000x).

-> $BNB Chain now hosts 5,886+ dApps, the most on any chain.

-> Total dApp volume has crossed $13.2TThe king of utility keeps proving… pic.twitter.com/W1HOR9yx1e

— Sujal Jethwani (@SujalJethwani) September 18, 2025

noted that this was “a mix of regulatory clarity and ecosystem maturity coming together at the perfect time.”

Macro Tailwinds

The Fed’s pivot marked a turning point. A 25bps rate cut lowered borrowing costs and improved liquidity across markets.

U.S. inflation cooled toward target levels.

- GDP growth remained steady, with a soft-landing outlook.

- Global frameworks like the EU’s MiCA added regulatory clarity.

These conditions favored risk assets. For crypto, it meant inflows into altcoins, and $BNB stood at the front of the line.

Crypto Market Context

The broader bull cycle amplified the move.

- $BTC broke $100K

- $ETH hit $4,600

The Altcoin Season Index spiked to 80, confirming rotation into alts.

$BNB benefited from ETF optimism as VanEck filed the first U.S. spot BNB ETF application. Open interest in BNB futures reached record highs, showing institutional and retail demand converging.

sakura_xbt called $BNB’s move “the breakout moment of alt season.”

Tokenomics and Utility

BNB’s fundamentals are deflationary and robust:

- Initial supply: 200M → reduced to ~139M after burns.

- Quarterly burn: 1.6M BNB in Q3 2025 alone.

- Ecosystem demand: Fees, staking, token launches, and trading discounts all require $BNB.

Daily transactions on BNB Chain have surged by 30% YoY. More than 5,886 dApps are live, driving cumulative dApp volume to $13.2T.

BNB just broke $1,000 today! @cz_binance

Diamond Hand 0x8503 spent less than $1K to buy 999 $BNB eight years ago, when the price was only ~$1.

Now, those 999 $BNB are worth ~$1M, a 1,000x return.https://t.co/DIkr8auXWA pic.twitter.com/4qZElFjyt5

— Lookonchain (@lookonchain) September 18, 2025

Institutional confidence has also grown. Nano Labs disclosed significant BNB accumulation, signaling corporate-level conviction.

Tech and Ecosystem Growth

BNB Chain has become one of the most advanced platforms in crypto.

- Lorenz + Maxwell upgrades cut block times to 0.75s and reduced gas fees to $0.01.

- opBNB rollup boosted throughput to 10K TPS, enabling GameFi and high-frequency trading.

- Security improved with AI-driven MEV protection. No major breaches were reported in 2025.

With 24B in tokenized RWAs and new integrations in payments, NFTs, and commerce, BNB Chain’s scope now extends well beyond trading.

Regulatory Breakthroughs

Binance’s $4.3B DOJ settlement once cast a shadow. But progress in 2025 flipped the narrative.

- DOJ signaled possible early removal of Binance’s compliance monitor.

- Binance gained licenses across Dubai, Japan, and Latin America.

- MiCA adoption in the EU gave BNB clarity as a compliant digital asset.

Together, these milestones reduced regulatory discounting in BNB’s valuation.

Social Momentum

Social euphoria amplified fundamentals. BNB1000 trended on X. Mentions surged across LunarCrush and Reddit. Search queries like “Buy BNB” spiked.

CZ’s subtle tweet of gratitude went viral, reinforcing holder conviction argued that social buzz added “psychological catalysts” to a fundamentally strong rally.

- Comparison to Past ATHs

- This cycle differs from 2021 and 2024.

- Then: retail-driven hype.

- Now: institutional inflows, ETF filings, and ecosystem maturity.

- Then: fragile tokenomics.

- Now: structured burns, higher TVL, more dApps.

In 2025, $BNB’s run is seen as more sustainable. Market maturity and structural strength underpin this rally, making $1,000 more than just a spike.

The rise of $BNB to $1,000 is a product of many forces:

- Favorable macro conditions.

- Regulatory breakthroughs.

- Strong tokenomics and ecosystem growth.

- Positive social momentum.

BNB is no longer just an exchange discount token. It has evolved into the backbone of one of the largest blockchain ecosystems in the world.

Whether $1,000 becomes a base or a springboard depends on how these forces evolve. But one thing is clear: $BNB’s ascent is rooted in fundamentals as much as narrative.

Follow the latest insights: CZ Binance…

Watching #BNB go from $0.10 ICO price 8 years ago to today's $1000 is something words cannot explain.

I, not representing any entity or title, as just a community member and a #BNB holder, thank everyone in the #BNB and crypto ecosystem, for your support.

We had our challenges…

— CZ 🔶 BNB (@cz_binance) September 18, 2025

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!