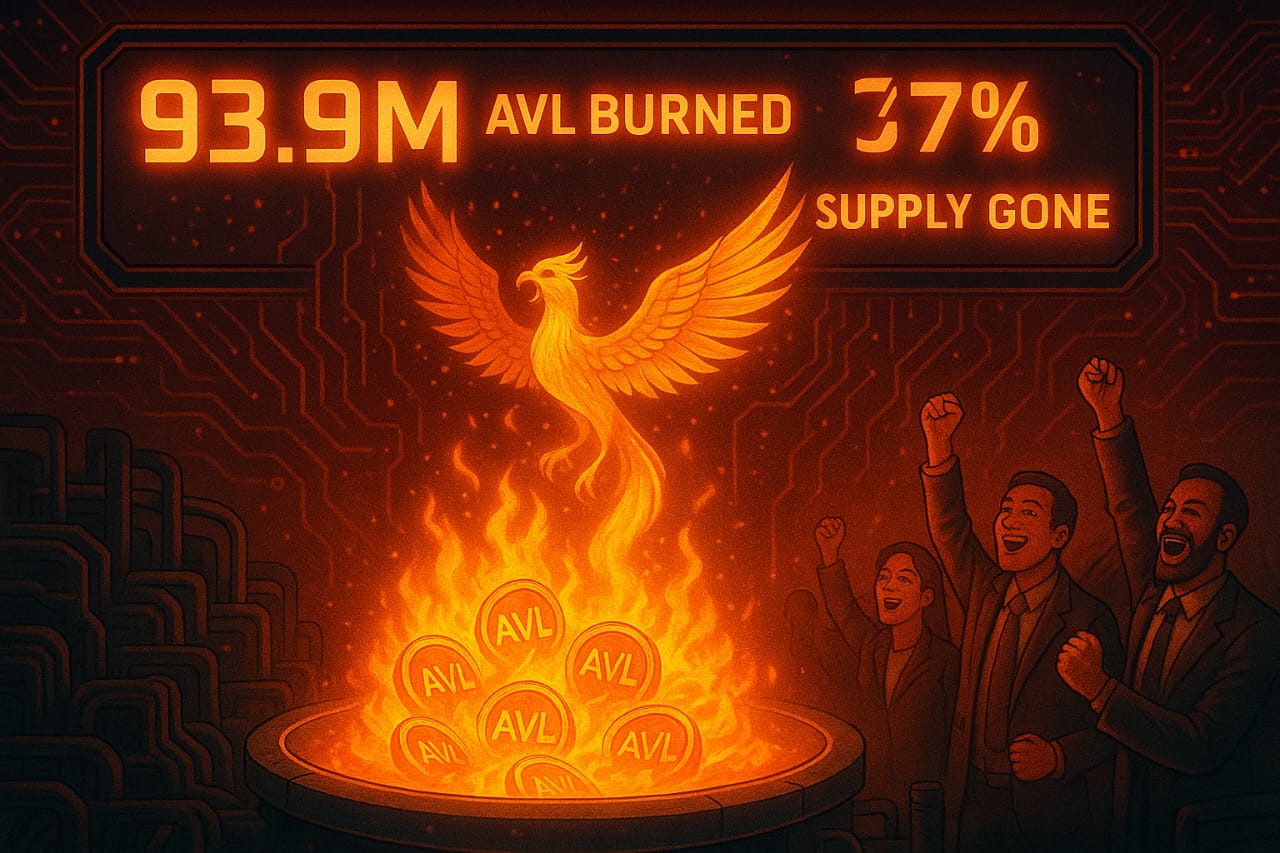

Avalon Labs (@avalonfinance_) has completed a massive buyback and burn of $AVL tokens, permanently removing 93.9 million AVL from circulation.

The move wipes out 37% of the total circulating supply.

The announcement triggered an immediate market reaction. According to CoinMarketCap, $AVL jumped 9% today to $0.15, pushing its market momentum higher after weeks of sideways trading.

Funded by Protocol Revenue

The $1.88 million buyback wasn’t just a headline move. It was fully funded by Avalon Labs’ monthly protocol revenue. That detail underscores the platform’s consistent usage and financial stability.

The company deposited 1.88 million USDT into Bybit in June 2025, executing strategic buys of $AVL at an average price of $0.1347 per token. In total, 13,955,164 AVL were repurchased during this round and permanently burned.

We’re pleased to announce the successful completion of a $1.88 million AVL token buyback and burn, reinforcing our long-term commitment to creating sustainable value for our community and ecosystem.

As part of this program, Avalon Labs deposited 1.88 million USDT into Bybit… pic.twitter.com/ADzrrfjfaM

— Avalon Labs (@avalonfinance_) September 10, 2025

Strengthening Long-Term Value

Avalon Labs said the initiative is a reflection of its commitment to sustainable growth. In a statement, the team emphasized that aligning protocol expansion with token holder interests remains at the core of its mission.

“This buyback and burn reinforces our long-term commitment to creating sustainable value for our community and ecosystem,” Avalon Labs noted.

The firm’s approach is designed not just to deliver immediate price impact but also to provide a deflationary mechanism that strengthens $AVL’s long-term fundamentals.

93.9M AVL Gone Since June

This latest move builds on an ongoing effort. Since June 2025, Avalon Labs has burned a total of 93,955,164 AVL tokens, permanently reducing supply.

The team says this equates to 37% of the circulating supply being wiped out in just a few months, a pace that sets Avalon apart from other DeFi protocols experimenting with token burns.

Mission to Build On-Chain Capital Markets

Avalon Labs is positioning itself as a leading on-chain capital market for Bitcoin. With this latest buyback and burn, the protocol signals confidence not only in its business model but also in its ability to deliver sustainable token economics.

The team added that it will continue exploring new, sustainable mechanisms to reinforce the Avalon ecosystem and reward long-term holders.

Community Response and Market Outlook

The buyback and burn program has been met with optimism across the Avalon community. Traders and holders see the initiative as a clear alignment of incentives.

Market watchers also note that burns of this magnitude can create positive supply-side pressure, particularly if demand for $AVL continues to climb with protocol growth.

At today’s price of $0.15, with supply cut by more than a third, the token’s long-term value proposition looks stronger than before the buyback campaign began.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!