Over 60% of traders who jumped into $YZY, the new memecoin launched by @KanyeWest on Solana, are deep in losses.

Out of 56,050 total traders, only 11,759 booked profits. That’s just 38% of everyone involved. The rest? They’re holding heavy bags.

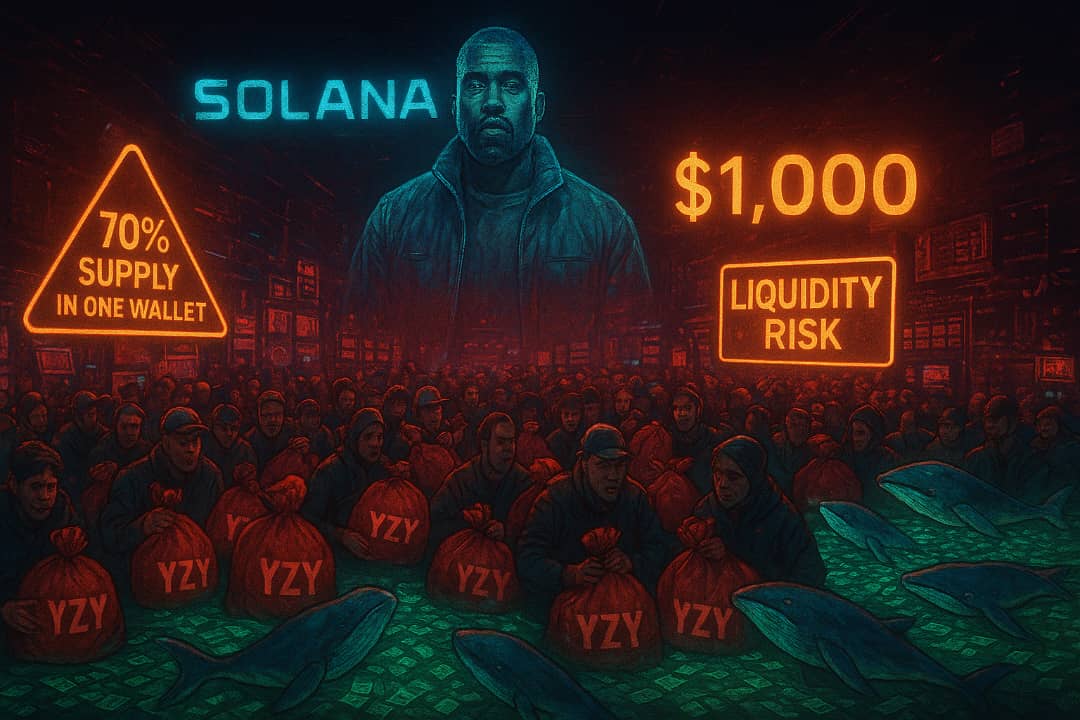

🚨 $YZY nears $1.

Thinking of buying the dip? HOLD UP!!!

Here are a few things you need to know before jumping in. 🧵👇 pic.twitter.com/shDvl4VHzt

— Wise Advice (@wiseadvicesumit) August 21, 2025

Data shows 523 traders lost between $10K–$100K each. Another 64 traders saw losses in the $100K–$1M range. Meanwhile, the top nine early whales made a combined $13.47M before the music stopped.

So what exactly happened with YZY?

The Launch That Shook the Market

Kanye West dropped a video. YZY went live. The hype machine went into overdrive.

Within five minutes, the token shot to a $2B market cap. By the 45-minute mark, it peaked at $3.16B.

Today? It sits at $1.03B, according to CoinMarketCap. That’s a stunning fall for a token that had the entire internet watching on launch day.

Quick snapshot from CoinMarketCap:

- Token: YZY (YZY)

- Chain: Solana

- Price: ~$1.05

Market Cap: $1.03B, currently below this mark, at the time of writing.

The launch was wild. The speed even crazier. But the aftermath is what people can’t stop talking about.

25 Contracts, One Real Token

YZY wasn’t just a single contract drop. Kanye launched it across 25 different contracts. Only one was real.

Bots had a 1-in-25 chance to snipe the right one. The idea? Give real traders a fair shot. Prevent bots from scooping up the entire supply in seconds like they always do.

And yes, it worked to some extent. But chaos reigned anyway. Prices swung violently. Early whales grabbed profits while latecomers stared at red portfolios.

🚨REPORT: Over 60% of traders are in loss on $YZY coin, launched by @KanyeWest on @Solana.

– Total Traders: 56,050

– 523 traders lost 10K – 100K $USD

– 64 traders lost 100K – 1 million $USD

– 11,759 traders (38%) booked profits pic.twitter.com/EdvSIzjd2V— SolanaFloor (@SolanaFloor) August 21, 2025

The Major Liquidity Problem

Here’s where the red flags start piling up.

A total of $120M liquidity got added to the token. But here’s the catch, it was only in YZY. No USDC in the pool.

That’s a huge issue. Without USDC pairing, the liquidity is fully controlled by whoever holds the YZY supply. It makes the price hyper-volatile and easy to manipulate. Insiders can pull or push liquidity at will, sending prices flying or crashing in minutes.

When liquidity isn’t neutral, the deck is stacked against retail traders.

Tokenomics Tilt the Wrong Way

Another major concern? 70% of YZY supply sits in the hands of Yeezy Investments LLC.

One entity controls the majority of the token. That’s not decentralization. That’s centralized power with the ability to nuke the chart whenever it wants.

For traders, this concentration of supply screams risk. If that wallet sells, the price collapses. If it holds, the market stays hostage. Either way, the control isn’t spread out like a healthy token should be.

The LIBRA TokenDéjà Vu

There’s more. Right as YZY launched, LIBRA unfroze $57.6M.

At the same time, the same wallets pulled out $1.5M instantly.

Coincidence? Some say yes. But many traders think this looks like a pattern that keeps repeating in crypto, big launches, sudden liquidity moves, same wallets involved.

Then there’s the legal side. YZY reportedly carries a “Class Action Waiver” in its terms.

Meaning if something goes wrong, you can’t file lawsuits together as a group. It makes coordinated legal action nearly impossible.

The hype is massive. But so are the red flags.

Where YZY Trades

Despite the drama, YZY is live on multiple CEXs:

- Gate.io

- KuCoin

- Bitget

- BitMart

- MexC

- BingX

- Binance Alpha

Liquidity is there. So is trading volume. But for many retail traders, the trust is already broken.

Winners, Losers, and Lessons

The numbers tell the story. Over 60% of traders are underwater. The early whales made millions.

Retail jumped in after the hype. They now hold bags worth a fraction of what they paid.

Meanwhile, centralization risks, shady liquidity setups, and weird wallet moves raise questions about whether YZY was ever built for long-term growth, or just a short-term spectacle.

YZY launched big. It drew the world’s attention. It gave early insiders massive profits.

But with 70% supply in one wallet, no USDC liquidity, and legal clauses blocking lawsuits, traders see more risk than reward now.

The hype is still there. The celebrity name still carries weight. But the red flags are impossible to ignore.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news!